In the changing financial landscape, mortgage companies and banks need to incorporate technology into their systems to stay competitive. Using technological solutions, such as artificial intelligence (AI), can simplify operations, improve customer experiences, and open up growth prospects. It is essential to make sure that everyone, regardless of their digital expertise, can still access the services they need.

Advanced technology allows financial institutions to automate routine tasks, which significantly reduces processing times. AI-driven systems for application processing, credit scoring, and document verification can speed up approvals, enabling customers to secure loans more quickly. This efficiency enhances customer satisfaction and increases the volume of transactions that institutions can handle without compromising quality.

Modern customers expect smooth and convenient interactions. Digital platforms, mobile apps, and online customer service portals offer round-the-clock access to accounts, loan applications, and support. These tools enable customers to manage their finances from anywhere at any time. AI can improve these experiences by providing personalized financial advice, tailored loan options, and predictive insights, which fosters greater customer loyalty and retention.

Incorporating AI enables banks and mortgage companies to utilize big data and advanced analytics. AI can analyze customer behavior, preferences, and creditworthiness to create precise risk assessments and targeted marketing campaigns. Machine learning algorithms can detect patterns and trends, allowing financial institutions to create products that address specific customer needs. Data-driven strategies lead to more informed decision-making and improved financial performance.

It is crucial to remember that, while digital transformation is essential, it is important to cater to customers who may not be as comfortable with technology. Providing multiple communication channels—such as in-person consultations, phone support, and traditional mail services—ensures that all clients receive the necessary support. User-friendly interfaces, tutorials, and assistance can help bridge the gap for those less familiar with digital tools.

It's important to embrace modern technology to avoid missing out on valuable opportunities. Competitors who invest in digital solutions have the potential to attract tech-savvy customers and take advantage of emerging trends. AI and blockchain technology have the power to transform the mortgage industry by enhancing transparency, security, and efficiency. Furthermore, fintech partnerships can bring in new and innovative products and services, expanding the capabilities and reach of traditional financial institutions.

Incorporating technology, particularly AI, into mortgage and banking systems is no longer optional; it is imperative for growth and survival. Financial institutions can stay ahead of the curve by streamlining operations, enhancing customer experiences, and leveraging data. However, maintaining a balance to ensure that non-tech-savvy customers are also well-served is crucial. Embracing AI and other technologies while prioritizing inclusivity will position banks and mortgage companies for sustained success in an increasingly digital world.

Momentum Loans

Today’s hyper-competitive market requires companies to be nimble, innovative, and flexible. Our experienced leadership allows us to make decisions quickly and build a culture around these key principals: operational excellence drives value, and technology drives opportunity.

NWA Real Estate Market Update

Breaking the Rules: Business Tips from Netflix’s Unconventional Culture

Discover the Secrets Behind Netflix's Success: Inside Their Game-changing Corporate Culture! Learn how freedom and responsibility, top-tier talent, candid communication, and a bold approach to innovation propel them to the top. Unlock the strategies that could revolutionize your business today!

Read Full ArticleHot Topics in the Media

New listings have peaked for 2024: It’s the second-lowest year on record

The highest number of new listings in one week was only 72,329 homes

-Housing Wire

Homebuilding permits set for slight rise in Northwest Arkansas this year

New housing units permitted per 10k people in the Northwest Arkansas metro area

-AXIOS

Surge in Commercial-Property Foreclosures Suggests Bottom Is Near

Lender portfolios of foreclosed and seized office buildings, apartments and other commercial property grew 13% in the second quarter

-WSJ

New Business Licenses

Learn MoreFeatured Weekend Events

Benton & Washington Counties

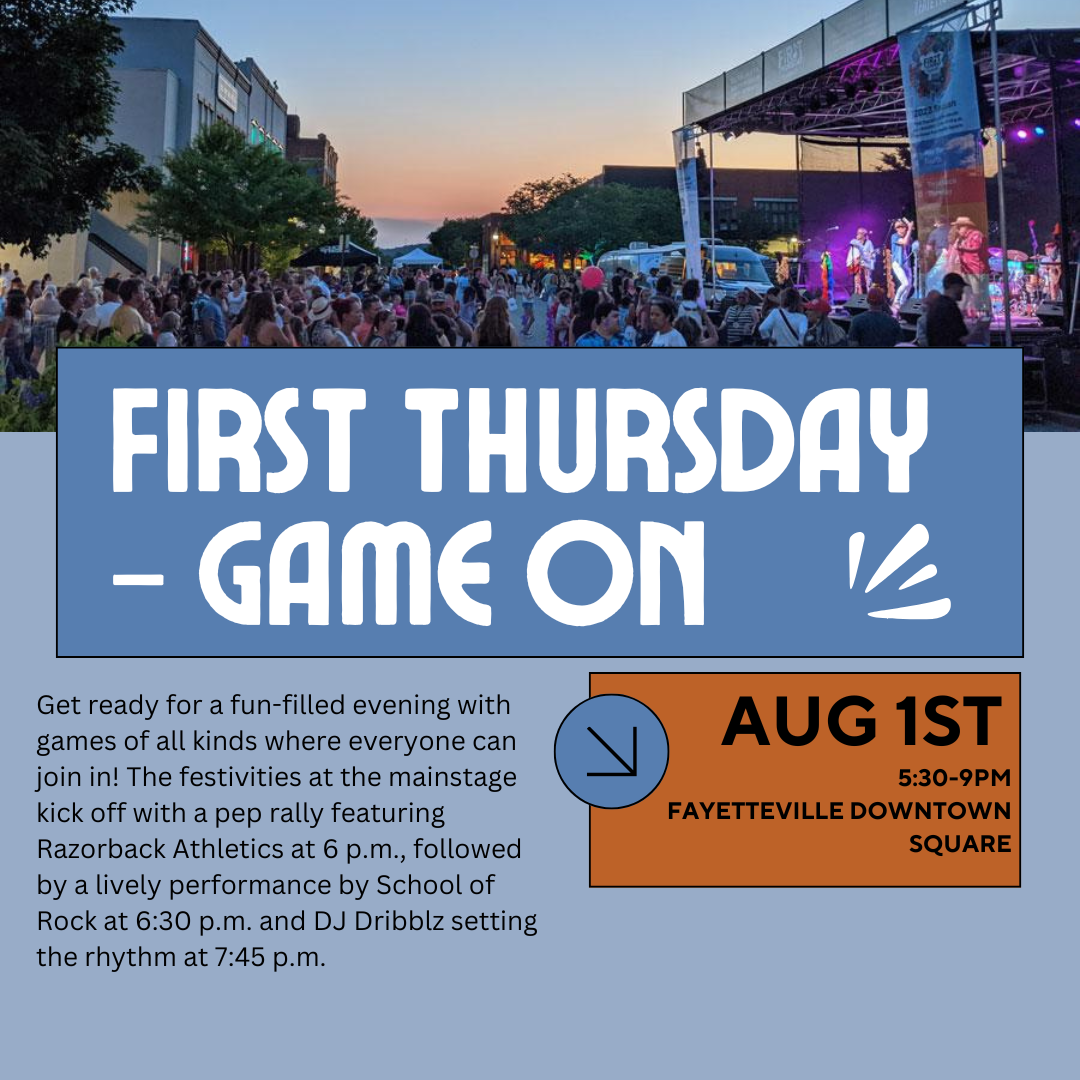

Featured Washington County Event This Weekend

Featured Benton County Event This Weekend