In a move that’s creating waves throughout the housing market, the Federal Reserve just announced a decrease in interest rates. For those of us who own or are looking to buy a home in Northwest Arkansas, this brings both opportunity and things to be aware of. Let’s break down what this means locally and how you can navigate these changes.

A Welcome Relief for Home Buyers

For prospective home buyers, lower interest rates can make financing significantly more feasible. With mortgage rates dropping, monthly payments on new loans are expected to decrease, making homes more affordable.

For example, a reduction of just 0.5% in interest rates can save buyers thousands of dollars over the life of a loan. This is particularly relevant in a competitive market like Northwest Arkansas, where homes have been flying off the shelves.

With these lower rates, many first-time home buyers may find themselves more confident in taking the plunge into homeownership. The dream of owning a home that once felt out of reach could suddenly become attainable, particularly for families looking for space in vibrant communities like Fayetteville or Bentonville.

Current Homeowners: Time to Refinance?

For those already settled in their homes, the decrease in interest rates could present an ideal opportunity to refinance existing mortgages. Homeowners might be able to lower their monthly payments, tap into equity, or shorten their loan terms—all of which can enhance financial flexibility. Refinancing can be a strategic move for those looking to invest in home improvements, pay off debt, or even save for future endeavors.

However, it’s essential to approach refinancing with a clear understanding of potential fees and the overall financial picture. Working with a local lender who knows the Northwest Arkansas market can provide valuable insights tailored to your situation.

Impact on the Housing Market

While lower interest rates generally stimulate home buying, they can also lead to increased demand, which could further drive up home prices in an already competitive market. For buyers, this means acting quickly and being prepared to make strong offers. For current homeowners considering selling, now might be an excellent time to list your property, given the increased demand from motivated buyers.

Navigating the Changes

So, what should you do if you’re looking to buy or refinance in Northwest Arkansas? Here are some actionable steps:

- Stay Informed: Keep an eye on interest rates and market trends. Subscribe to local real estate newsletters like NWA Look or consult with professionals who can provide up-to-date information.

- Get Pre-Approved: If you’re a buyer, securing pre-approval for a mortgage can give you a competitive edge in negotiations. This shows sellers you’re serious and prepared.

- Consult Local Experts: Whether you’re buying or refinancing, talking to local real estate agents and mortgage lenders can provide tailored advice based on your unique situation.

- Act Quickly: In a fluctuating market, timely decisions can make a significant difference. If you find a property you love, don’t hesitate—act decisively.

Moving Forward

The recent decrease in interest rates presents a unique moment for both home buyers and current homeowners in Northwest Arkansas. With thoughtful planning and the right guidance, you can take advantage of this shift, whether you’re stepping into homeownership for the first time or looking to enhance your current living situation. As always, stay proactive and informed to make the best decisions for your financial future.

Business Summit

Collier & Associates is excited to announce our first-ever C&A Business Summit, taking place on October 17th.

This summit will gather change-makers across Northwest Arkansas, including business leaders, economists, marketing and branding professionals, real estate experts, and more, all united in our mission to shape a better future for NWA.

Our distinguished lineup of guest speakers features Mervin Jebaraj, Director of Economic Research at the University of Arkansas, Jordan Wright, Founder and Owner of Wright’s BBQ, Graham Cobb, the visionary behind the “Because Bentonville” economic development project, Ashley Knight, Chief Operating Officer at Harvest Group, and Nelson Peacock, CEO of the NWA Council.

Registration opens on September 1st—mark your calendars and join us for this impactful event.

NWA Real Estate Market Update

Top 5 Tips for a Gorgeous Garden on a Budget

Whether you’ve been living in your home for years or are excited to put your stamp on your new digs, creating a new garden or improving the one you’ve got can be one of the most satisfying parts of homeownership, and late summer/early fall is a great time to do it.

Read Full ArticleHot Topics in the Media

Memorial Day tornado victims get more than $5 million

FEMA awarded about $5.26 million to Benton County residents affected by the Memorial Day storms

-AXIOS

The Advantages Of In-Person Vs. Hybrid Or Remote Work In Real Estate

With the onset of Covid, along with advancements in technology that have made it easier to connect from anywhere, the landscape of work has changed significantly during the last years.

-Forbes

NWA real estate remains strong as Skyline Report celebrates 20 years

Even though prices continue to balloon, Northwest Arkansas' real estate market remains vibrant, according to the latest Arvest Skyline Report, which marked its 20th year today.

-AXIOS

New Business Licenses

Fayetteville welcomes a talented goldsmith and jewelry designer, bringing a passion for creating one-of-a-kind fine jewelry to the community. Specializing in designing custom pieces for individuals who value quality craftsmanship and seek something truly unique, this artisan believes each person has distinct passions and dreams. Through their work as a goldsmith, they capture that individuality in every piece of jewelry created. With a wide selection of metals, gems, and shapes, clients can express their personal stories through wearable art. Be sure to check out Julia Fryer Fine Jewelry to explore more.

Learn MoreFeatured Weekend Events

Benton & Washington Counties

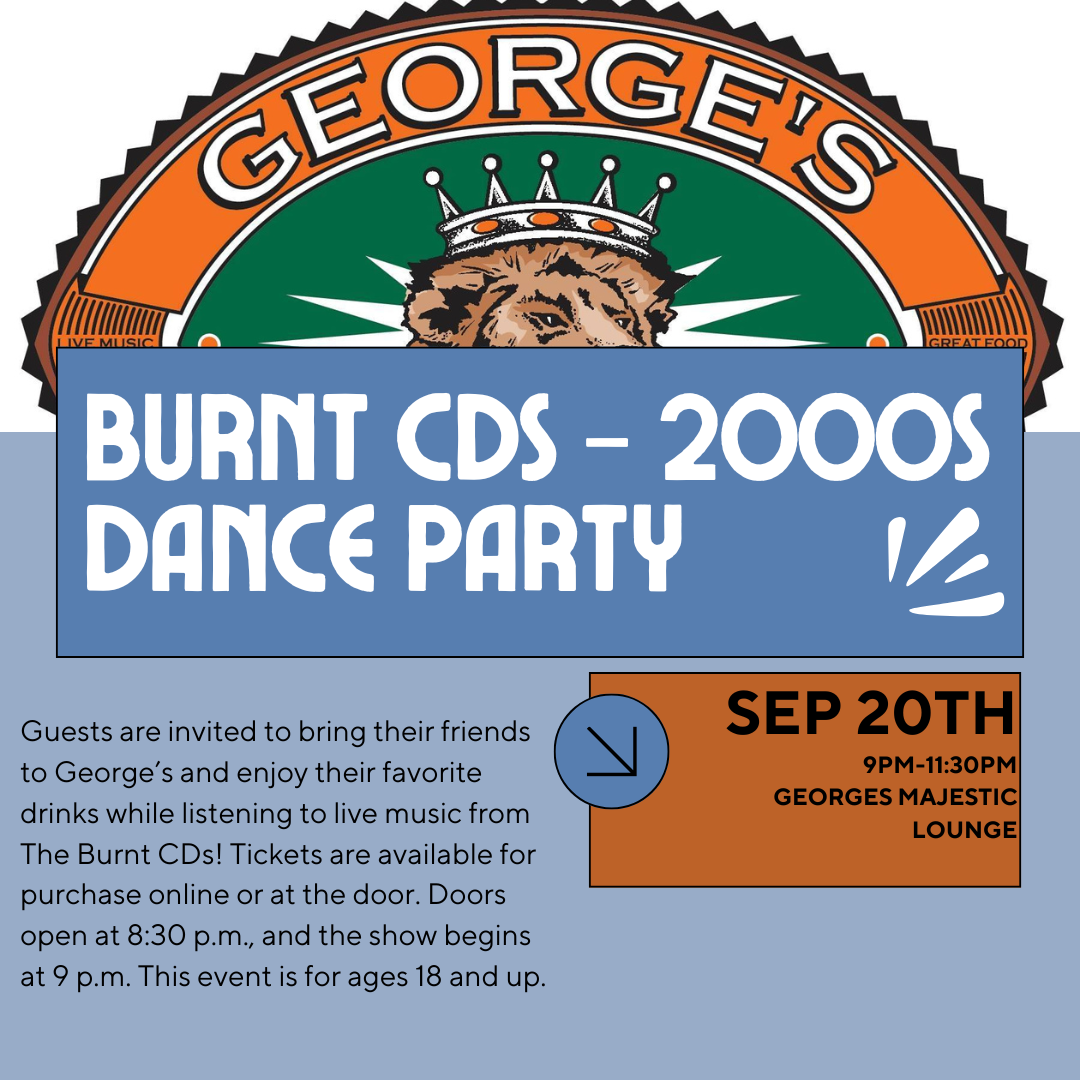

Featured Washington County Event This Weekend

Featured Benton County Event This Weekend