Experiencing property damage can be overwhelming, especially in the wake of recent severe storms and tornadoes that have struck Benton County. However, by following these essential steps, you can effectively navigate through the challenges ahead. In response to the devastation, numerous businesses and community members have united to provide support to those affected. Here's a comprehensive guide to help you understand insurance coverage and access the available resources during this difficult period.

Benton County Resources

Benton County Storm Debris Drop-Off Location Update:

Residents can dispose of storm debris at the Benton County Fairgrounds, located off Hwy 279/S Vaughn Rd. Drop-off is available at the north parking lot from noon to 8 p.m. on May 29, and from 7 a.m. to 7 p.m. daily, except Sundays, thereafter. Accepted items include vegetative debris such as root balls, logs, tree branches, leaves, and brush. Please note that construction and demolition debris will not be accepted at this time.

Benton County Emergency Management:

Report damage and access other helpful information at Benton County Emergency Management.

Local Support and Assistance:

Walmart Inc., in partnership with the Walmart Foundation, is supporting its hometown after severe storms and tornadoes with a commitment of up to $2 million for immediate relief efforts.

Meal Services:

- Operation BBQ Relief: Serving meals on Wednesday, May 29, at Rogers Police Station, 1901 South Dixieland Road, Rogers, AR.

- Walmart and Tyson: Serving meals on Wednesday, May 29, at Walmart Neighborhood Market #3654, 808 W Walnut St, Rogers, AR.

WiFi & Charging Stations:

- Walmart.org provides WiFi hotspot and charging stations at Walmart Neighborhood Market #3654, 808 W Walnut St, Rogers, AR, and Orchards Park, Southeast corner of NE J St and John DeShields Blvd.

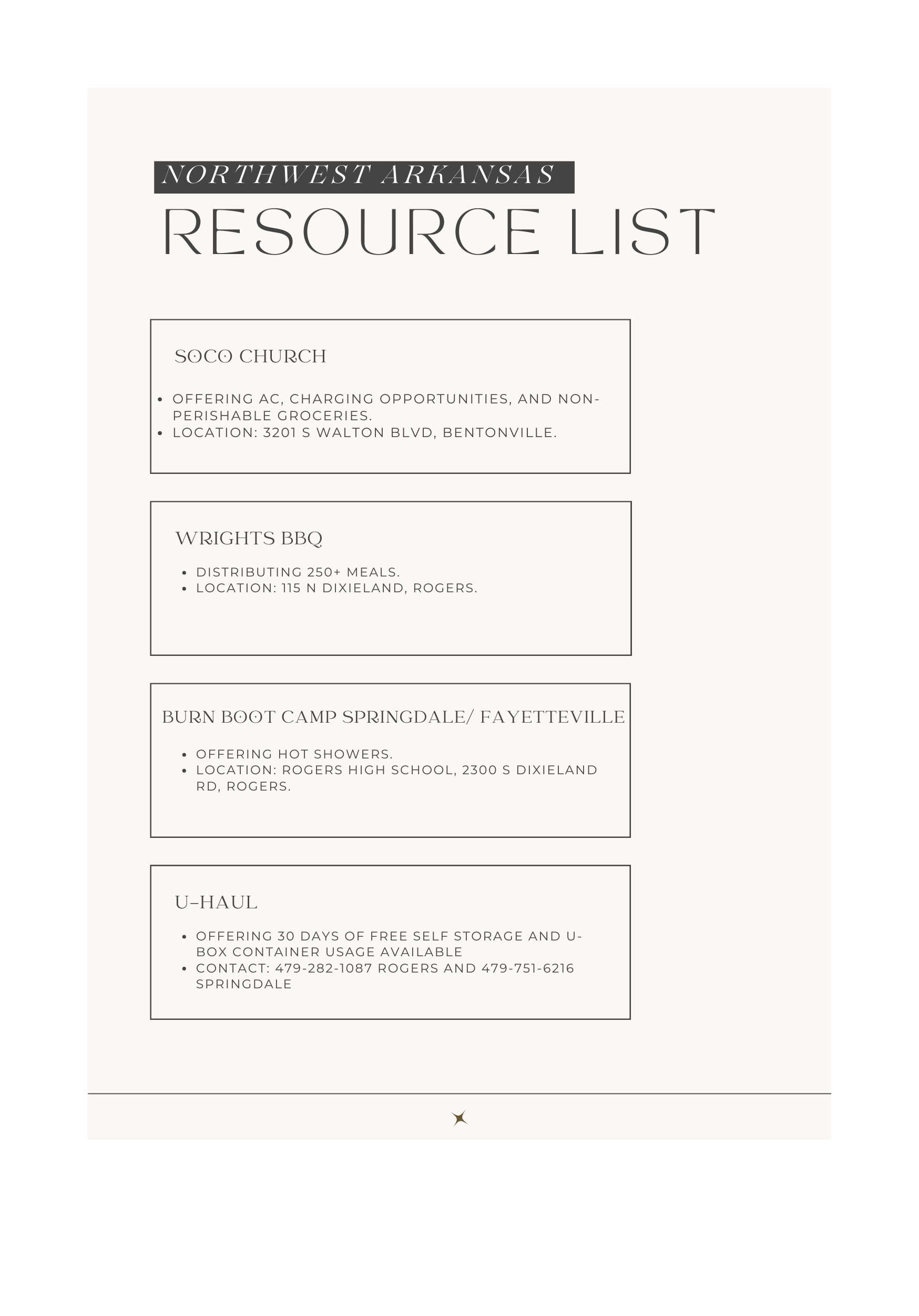

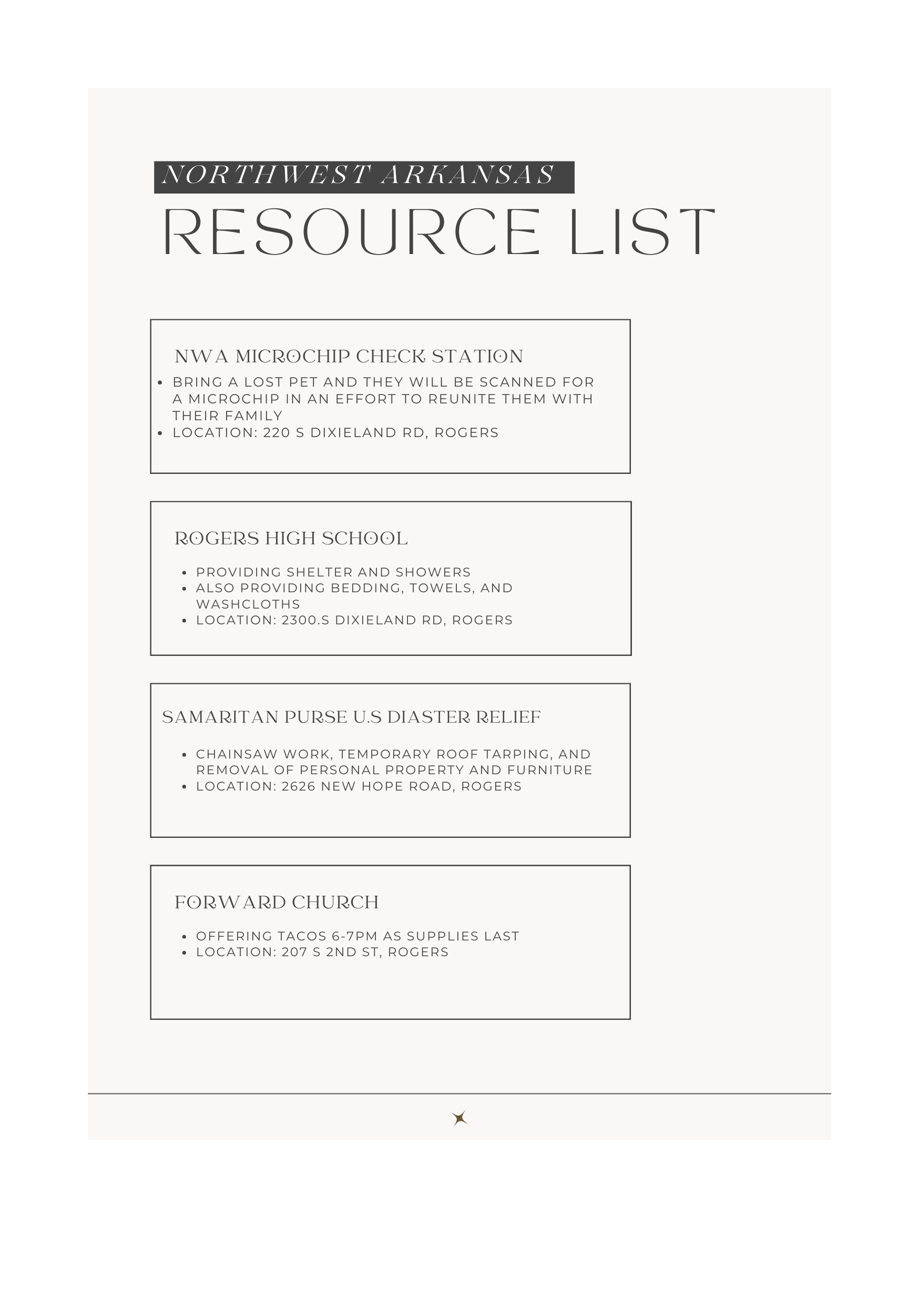

Resources in Northwest Arkansas

Vegetative Debris Drop Site:

Benton County has opened a vegetative debris drop site at the North Parking Lot of the Benton County Fairgrounds, located off Highway 279 and South Vaughn Road in Bentonville.

Understanding Your Insurance Coverage

Check Your Coverage: It's important to understand what your homeowners insurance covers. For example, it may cover repairs if a tree falls and damages your property. Check for "loss of use" coverage, which can help with additional living expenses if you need to relocate temporarily.

Separate Claims: Damage to your car requires a separate claim with your auto insurance.

Homeowner Responsibilities

Immediate Action: Take immediate steps to prevent further damage:

- Make Minor Repairs: Cover a damaged roof with a tarp to prevent water from entering.

- Document Damage: Take photos and videos of all damage, including your car, roof, and other affected property.

- Ensure Safety: Avoid unsafe areas and hazards like downed power lines or gas leaks. If you smell gas, turn off the supply and contact your gas company immediately.

Contact Your Insurance Company: File a claim as soon as possible. Provide photos, videos, and a detailed list of damaged items.

Temporary Repairs: Make necessary temporary repairs and keep receipts for materials used.

Contacting Your Insurance Company

File an Insurance Claim: Contact your homeowners insurance company promptly. Provide documentation and follow their guidance.

Auto Insurance Claim: Report vehicle damage separately to your auto insurance. Provide photos and estimates for repairs.

Meet with the Adjuster: Accompany the insurance adjuster during their assessment to ensure all damages are accurately documented.

Additional Steps

Secure Your Home: If your home is uninhabitable, find temporary housing covered by your insurance under "loss of use" coverage.

Get Repair Estimates: Obtain detailed estimates from licensed contractors to compare costs.

Keep Records: Maintain a file of all communications with your insurance company and contractors.

Financial Assistance: Check eligibility for federal or state disaster assistance programs like FEMA.

Filing the Claim

Know Your Deductibles: Understand your policy deductibles and coverage details, including exclusions like wind or hail damage.

Policy Coverage: Review what your policy covers, such as dwelling, personal property, and other structures.

Claims Process: Report damage, meet with the adjuster, review settlements, and understand your rights. Document all communication for reference.

Navigating property damage and insurance claims can be complex, but by following these steps, you can manage the situation effectively. Always consult with your insurance agent for specific guidance related to your policy and situation.